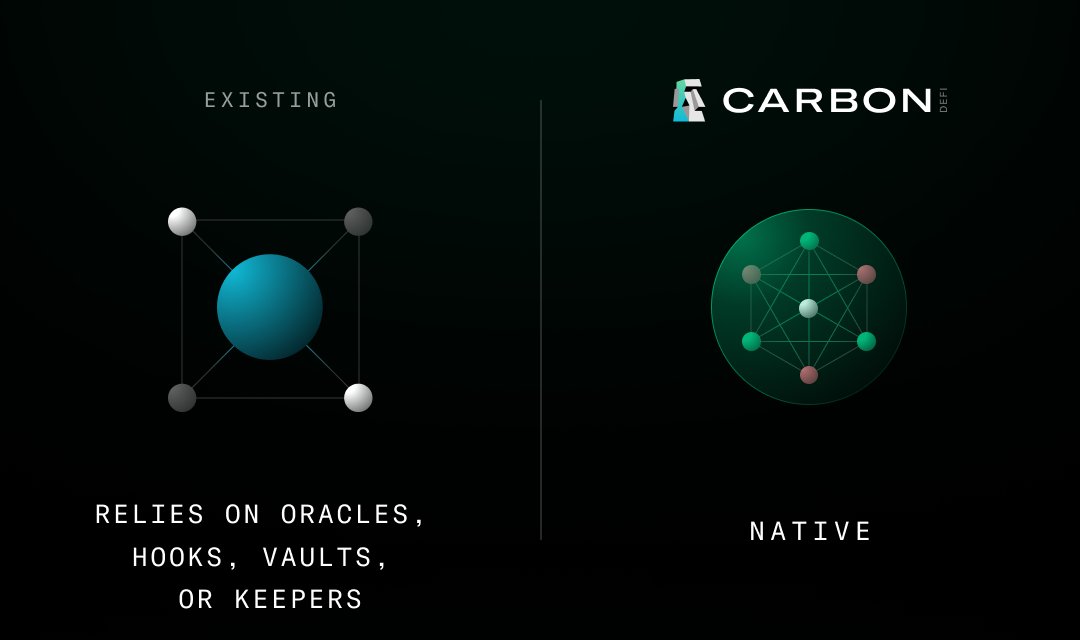

Most DEXs weren’t designed to function beyond basic liquidity provision and swaps. To move beyond their foundational limitations, they rely on third parties:

• Oracles and keepers for Limit Orders

• Hooks to extend functionality

• Vaults and keepers to monitor and manage compounding fees

These add cost, complexity, and potential risk.

@CarbonDeFixyz is built differently. Limit Orders, Range Orders, Recurring Orders, and Auto-Compounding Concentrated Liquidity are all native features of the protocol.

No external dependencies. No unnecessary risks.

Advanced capabilities without external dependencies, delivered by design.

4.02K

21

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.