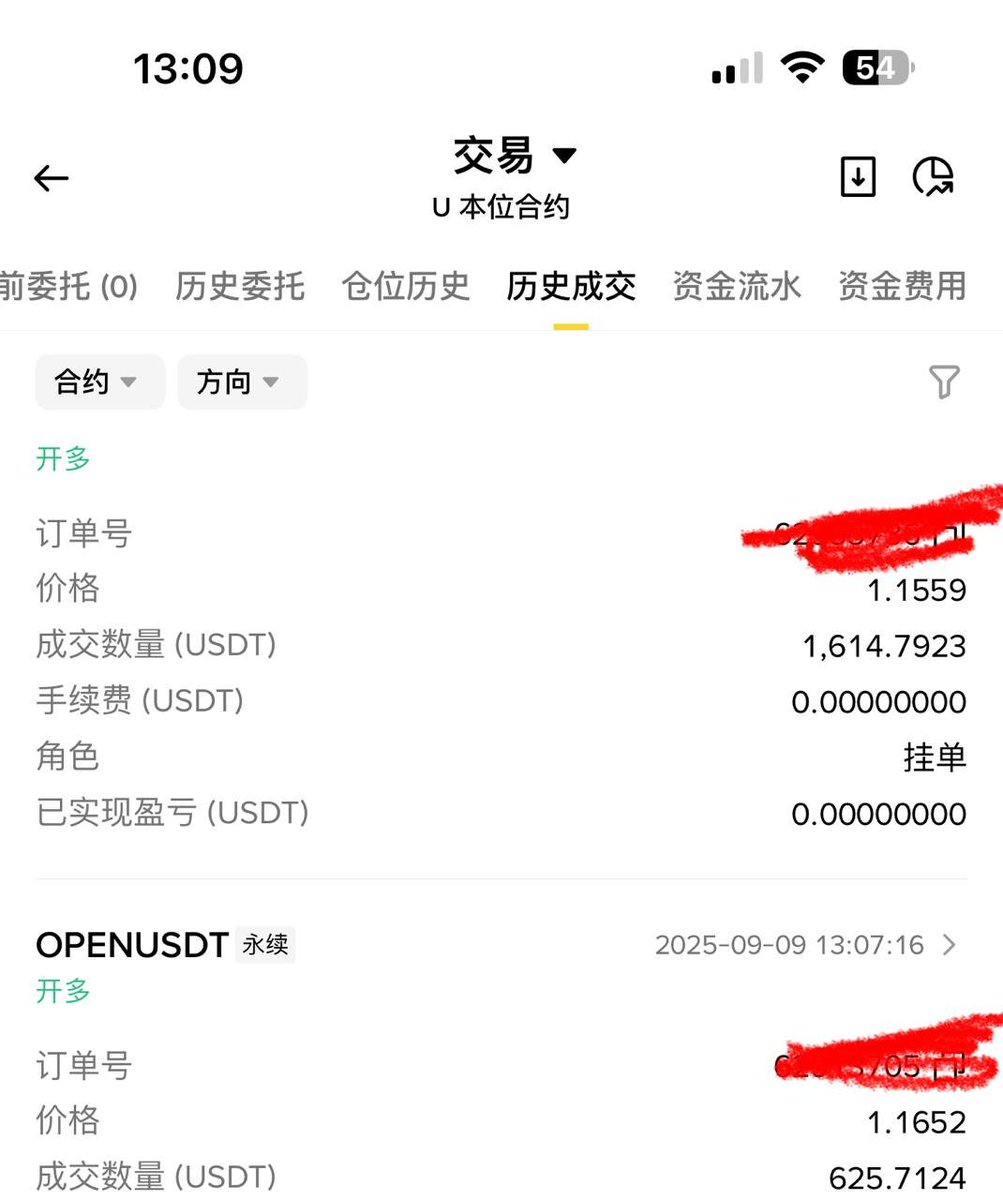

$open Profit 1.3 W

Never after the horse

Because there was a head warehouse before

alpha hedged once

Added to the large position

Reviewing the logic of going long on $OPEN at 0.6861 yesterday.

If it was merely the alpha selling pressure that was digested, it would create room for a spot rally when going long at 0.68 with a market cap of 100 million, which would be a high odds play.

The 1.1 rolling position is based on order book and research logic, and to conclude:

I will parallel OpenLedger with $sahara and $tao, believing it has the genes of a top-tier exchange.

To illustrate its significance in the AI sector:

When you ask GPT or DeepSeek, how do you know the response you receive is fair?

Even if the AI's large predictive model is fair, the presentation on the application side is beautified; how do you make decisions?

You can verify this by asking the same question to different AIs.

This is the meaning of decentralization, and behind decentralization lies:

Data foundation --- training of large language models --- support of computing power --- presentation of applications.

When AI replaces the internet as the economic driving revolution, how much do these underlying components contribute to the value generated?

AI has always developed in a "black box" model: after data input, the value is monopolized by centralized enterprises, while contributors receive nothing.

OpenLedger @OpenledgerHQ has launched the "Proof of Attribution (PoA)" mechanism, helping to build an economic system in the AI field that is "traceable, visible, and rewarding" for contributions.

Many restructurings of production structures are based on a distribution system obtained through labor, so I believe there is an irreplaceable nature in the native AI narrative within the crypto space.

In this distribution system, we can view AI as an economy:

Data is a new type of resource

Models are production factories

Agents are laborers

OpenLedger makes it transparent, liquid, and fair. With the $OPEN token, the AI field finally has its own native currency.

The second point is considering the strength behind it:

In terms of data: OpenLedger has processed a total of 300TB of data, corresponding to 21.18 million transactions — each one is a verifiable "smart transfer" record on-chain, and the network currently has 1.27 million wallets.

In terms of applications: Collaborations have been established with global companies such as Walmart, Sony, Meta LLaMA, and Viacom.

In terms of native capital: It secured a seed round from Polychain, and its consensus adopts Stanford's proof of attribution, with both capital and narrative being top-tier. (The seed round for $sahara didn't have this much).

Therefore, compared to the native narratives of web2, OpenLedger has the genes to build a decentralized AI economy for web3, and the opening valuation of 100 million is underestimated.

Currently, the second phase of the alpha airdrop has been completed, and I opened a long position on Open at 1.15 for research purposes.

61.63K

57

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.